Individual Services

구비서류 발급 방법

Part 1. 근로 / 기타 / 퇴직소득 원천징수영수증 발급 방법

1. 홈택스 접속 및 로그인 (www.hometax.go.kr)

2. ‘My홈택스’ > ‘연말정산/지급명세서’ > ‘지급명세서 등 제출내역’ 클릭 (보고 대상 연도 모두 출력)

Part 2. 종합소득세 / 양도소득세 / 상속세 / 증여세 과세표준 확정 신고 및 납부계산서 발급 방법

※ 거래하는 세무사 사무실이 있다면 전화로 발급 요청하시면 됩니다.

1. 홈택스 접속 및 로그인 (www.hometax.go.kr)

2. ‘조회/발급’ > ‘세금신고납부’ > ‘전자신고결과조회’ 클릭 (보고 대상연도 모두 출력)

3. 신고일자 기간 설정, 주민등록번호 입력

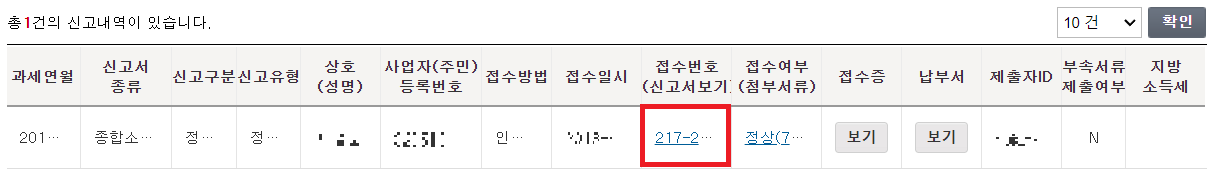

4. 반드시 ‘접수번호(신고서보기)’에 있는 링크 클릭

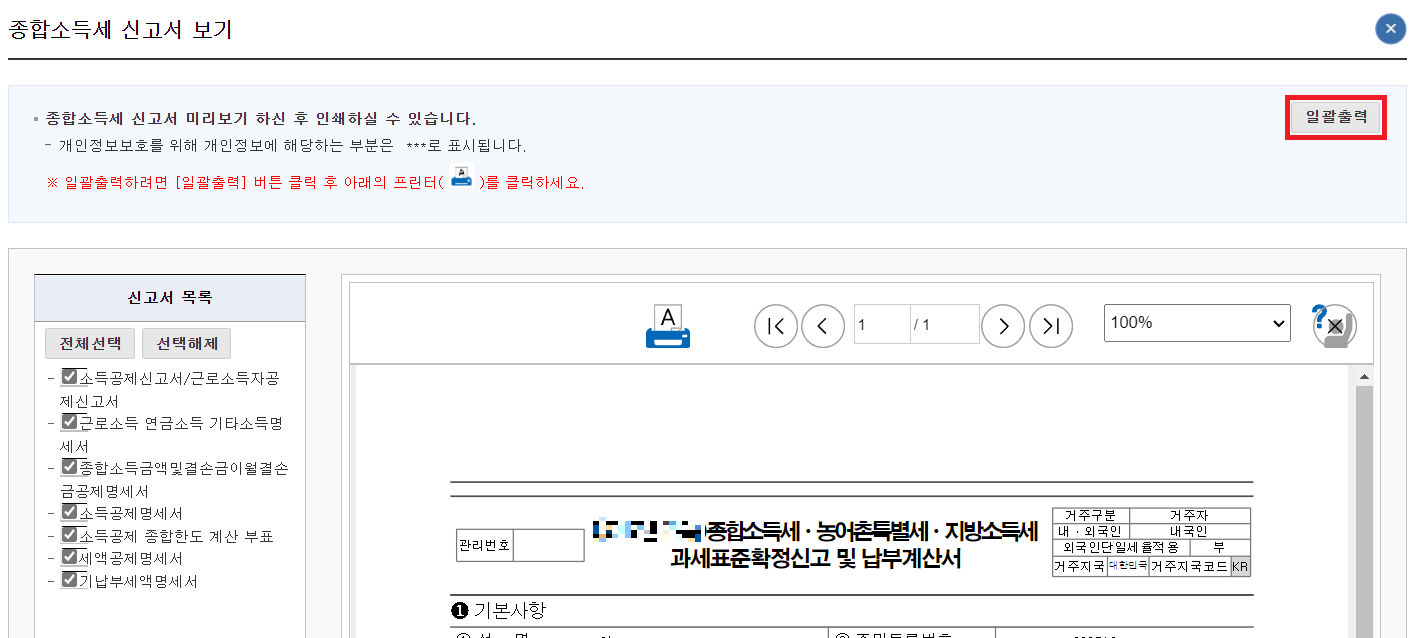

5. 신고서가 나오면 프린트 아이콘을 클릭하지 마시고 반드시 ‘일괄출력’으로 발급

Part 3. 재무제표 및 손익계산서 발급 방법

※ 거래하는 세무사 사무실이 있다면 전화로 발급 요청하시면 됩니다.

1. 홈택스 접속 및 로그인 (www.hometax.go.kr)

2. ‘민원증명’ > ‘민원증명발급신청’ > ‘표준재무제표증명’ 클릭 (보고 대상 연도 모두 출력)

3. 입력사항 기입 후 ‘신청하기’ 클릭

Part 4. 은행 및 증권사 이자 및 배당소득 원천징수 영수증 발급 방법

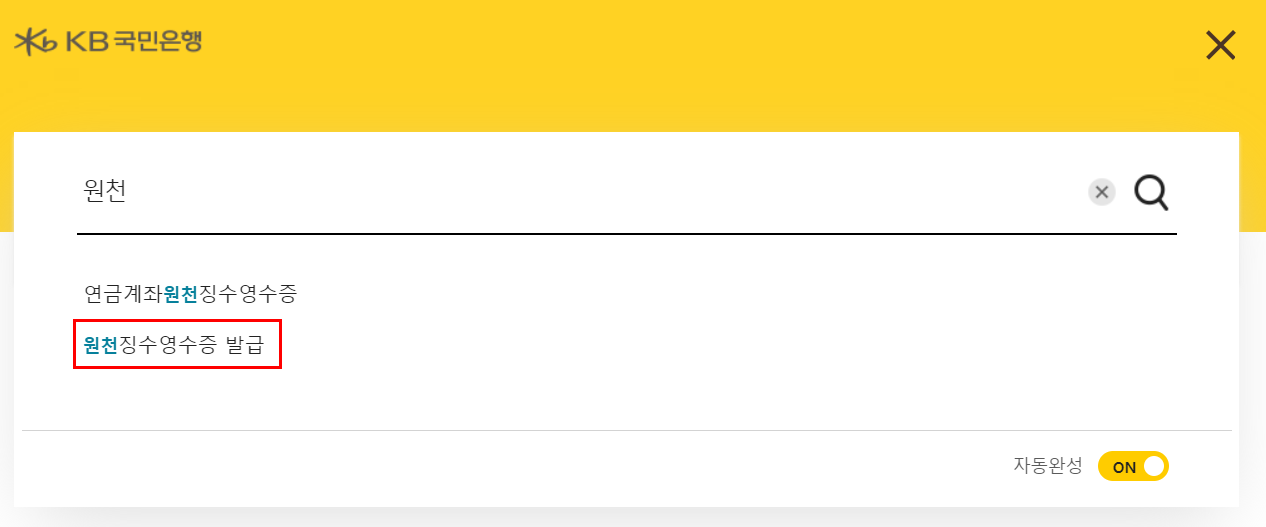

1. 은행 홈페이지 접속 및 로그인

2. 보통 우측 상단에 위치한 검색창에 ‘원천’으로 검색 후 ‘원천징수영수증 발급’ 메뉴로 이동

3. 발급 원하는 기간 기입 후 각 계좌별 발급

FAQ

Most Frequently Asked Questions

프린트 아이콘을 클릭하여 인쇄했을 경우에 발생하는 사항입니다. 우측 상단에 ‘일괄출력’을 클릭하여 인쇄하셔야 모든 페이지를 인쇄하실 수 있습니다.